The Premium Tax Credit (PTC) makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace (also referred to as the Marketplace or Exchange).

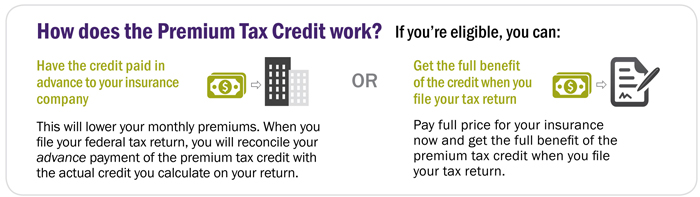

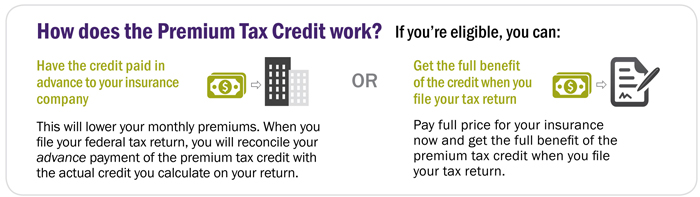

There are two ways to get the credit. If you qualify for advance payments of the premium tax credit (APTC), you can choose to have amounts paid directly to the insurance provider to help cover your monthly premiums. You can also choose to get all of the benefit when you claim the PTC on your tax return.

IMPORTANT: What Happens If I Received a Notice from the IRS That I May Lose My Advance Payments?

If you receive IRS Letter 12C asking you to reconcile your advanced payments by submitting Form 8962 and warning you that if this is not completed, you may lose the opportunity to continue to receive these advanced payments, you must take immediate action!

To continuing receiving advance payments of the Premium Tax Credit, you must provide Form 8962, but you also need to self-attest on your health insurance marketplace website. To do this, log into your marketplace account and follow instructions there.

Even if you have already reconciled your advance payment with the IRS, you will still need to log into your marketplace account and self-attest due to COVID-19 related processing delays at all IRS locations.

In order to make the PTC work for you, it’s important you understand the benefits and responsibilities of both situations. See the What should I do? section for more details.

Your PTC may change if your income or family size changes during the year. See Changes in Circumstances in the How will this affect me? section below. To see how much these changes can affect your credit, try the Premium Tax Credit Change Estimator.

If you are eligible, you can: Have the credit paid in advance to you insurance company or get the full benefit of the credit when you file your tax return.

Premium Tax Credit Change Estimator

Helps you estimate how your premium tax credit will change if your income or family size changes during the year.

Determine if you are eligible to claim the Premium Tax Credit (PTC)

To be allowed PTC for a taxable year, you must meet 1 and 2 below:

Decide if you want to receive advance payments of the Premium Tax Credit or get all of the credit when you file your return

If you enroll in coverage through a Marketplace and request financial assistance, the Marketplace will calculate your estimated premium tax credit, using an estimate of all of your household income and other information such as your address, your family size, and who in your family can enroll in non-Marketplace insurance.

At that point, you can choose advance payments of the PTC – where all or part of the estimated premium tax credit is paid to your insurance company, which reduces your monthly premiums — or you can choose to pay all of the premiums, and get all of the benefit of the PTC when you file your tax return, as explained below.

Advance Payments of the Premium Tax Credit

If you choose advance payments of the premium tax credit (APTC), the Marketplace pays your estimated credit directly to your insurer for you, reducing your monthly premium.

When you file your tax return at the end of the year, you’ll compare the amount of your estimated PTC the Marketplace paid out for the year to the amount of PTC you are allowed. The PTC you’re allowed is based on your actual household income, family size, address, and who in your family is eligible to enroll in non-Marketplace coverage. You’ll enter these amounts on IRS Form 8962, Premium Tax Credit (PTC), which you file with your tax return. If there is a difference, your tax bill or refund may change.

This end-of-year reconciliation of the advanced premium tax credit and the actual credit is why it is important for you to promptly report any changes in circumstance to your Marketplace (see the How will this affect me? section, below).

Premium Tax Credit on Your Tax Return

If you choose to forego advanced payments, you’ll get all of the benefit of the PTC when you file your tax return. In that case, your entire credit will either reduce the tax you owe or result in or add to a refund.

You may want to forego advanced payments, if you can pay your full monthly premium and your income varies widely during the year or you expect to receive some sort of large lump sum payment later in the tax year. This would keep you from having to contact the Marketplace to recalculate your advance credit during the year or possibly repay advanced amounts.

File a tax return

If you receive the premium tax credit, you must file a tax return, even if you are not otherwise required to file.

You should wait to file your tax return until after you receive a Health Insurance Marketplace Statement (IRS Form 1095-A) in the mail – probably in early February. It will come from your marketplace, not from the IRS.

The form will have all the information you need to file IRS Form 8962, Premium Tax Credit (PTC), including the amount of any advance payments of the premium tax credit that were paid to your health plan during the tax year. You’ll need to complete IRS Form 8962 and file it with your regular tax return.

Note: Form 8962 can also be claimed on the new IRS form 1040 SR, U.S. Tax Return for Seniors, for taxpayers age 65 and older.

If you do not receive the IRS Form 1095-A or the information on it is incorrect, you must contact your marketplace. If you don’t have that contact information, it is available on IRS.gov.

If you get Advanced Premium Tax Credit (APTC), you must file a tax return at the end of the year, even if you don’t have to file one otherwise.

Reconciling APTC and PTC at the end of the year

The PTC is unusual because, unlike other credits, you may be eligible for advance payments of the estimated PTC during the course of the year. But remember, those advance payments are only an ESTIMATE of your PTC, based on information you provide like your projected household income and family size. If your actual household income or family size is different from the projected amount, the PTC you’re allowed will be more or less than your APTC.

If you’re receiving the benefit of APTC, it is important to notify your Marketplace (not the IRS) if you have a change in circumstance. Providing the Marketplace with up-to-date information will reduce the chance that your APTC is significantly more or less than the PTC amount you’re allowed.

Changes in Circumstances

Changes to income or family size are often called changes in circumstances. If the advance credit is paid for you or a family member and you have a change in circumstances, you should promptly report it to your Marketplace, so the Marketplace can adjust your APTC. This will help prevent large differences between your APTC and the PTC you’re allowed and reduce the chance that you’ll owe money or get a smaller refund when you file your tax return.

Changes in circumstances to report to the Marketplace include:

*Note – Lump sum distributions such as social security disability insurance (SSDI) are often missed as changes in circumstances. These amounts can be sizable and result in an APTC recipient having to repay large amounts or even all of the APTC paid to an insurer for them. When possible, be sure to consider potential receipt of SSDI or similar income when estimating your household income if you’re electing APTC. In addition, be sure to report receipt of these amounts to the Marketplace as a change in circumstance to help reduce the chance you’ll owe money or get a smaller refund when you file your tax refund.

For example: If you get a new job with a higher salary, the increase in household income means the PTC you’re allowed goes down. If you don’t tell the Marketplace about the increase in household income, your APTC, which was computed based on your household income before the salary increase, will likely be more than the PTC you’re allowed. When you file your tax return, you must increase your tax liability by some or all of the difference, which will either reduce your refund or increase the amount of tax you owe with the return.

If your spouse decides to go from full-time work to part-time and your family’s household income goes down, you may qualify for a larger PTC. If you report the change to the Marketplace, you may be able to increase your monthly APTC to help pay your monthly premiums.

Note: For tax year 2021, any taxpayer who received, or was approved to receive unemployment compensation is treated as an applicable taxpayer and as having household income of no more than 133 percent of the FPL. Taxpayers check a box on Form 8962, line 6 to show they received unemployment compensation.

If you want to see how a change of circumstance might affect your PTC, you can use the PTC Change Estimator. But remember – contact your Marketplace to report a change of circumstances.

If you end up owing money when you file your tax return, it can be paid electronically at IRS.gov. If you can’t pay what you owe, there are other options.